Trump has become seriously overconfident. Republicans in Congress now face a dilemma similar to what Democrats faced last summer when it became apparent how senile Biden was.

The senate vote against Canadian tariffs is just the beginning of congressional resistance.

Voters in swing states a month or two from now will put more pressure on Republican politicians to change course. As with Biden, leaders will be slow to speak out against Trump until after most of them have privately decided on some sort of break with him.

It seems very likely that there will be some sort of dramatic confrontation between Trump and Congress and/or the courts. The outcome may be quite messy, but I don’t see how Trump can avoid being widely recognized as a pathetic loser. If the Republican party doesn’t distance itself enough from Trump soon, it will become a minority party for quite some time.

I doubt that a recession could be avoided merely by Trump conceding to reduce tariffs. The uncertainty that he creates is roughly half the problem. Economic recovery depends on a clear signal that the US is a safe place for business, such as Trump leaving office or being restrained by another branch of government.

What does this mean for the stock market?

The historical analogies that I can find aren’t very close, but weak analogies are better than nothing.

My main analogy is the Carter Administration’s credit controls (March 1980), which caused a short recession. The market dropped 7% in two weeks after they were announced. It took nearly 2.5 years for a sustained recovery to begin. But the harm from the credit controls, which were clearly intended as a temporary measure, probably ended within a couple of months.

My second analogy is 9/11. The market dropped nearly 12% in 10 days, then recovered enough that the decline in 2002 was likely unrelated. If the US unites against tariffs as clearly as it united against Al Qaeda, then I’d be buying now. But Trump would likely need to make another mistake to produce that much unity.

Tariffs are likely doing somewhat more harm than those two events, but it’s fairly plausible that the markets have mostly reflected the effects.

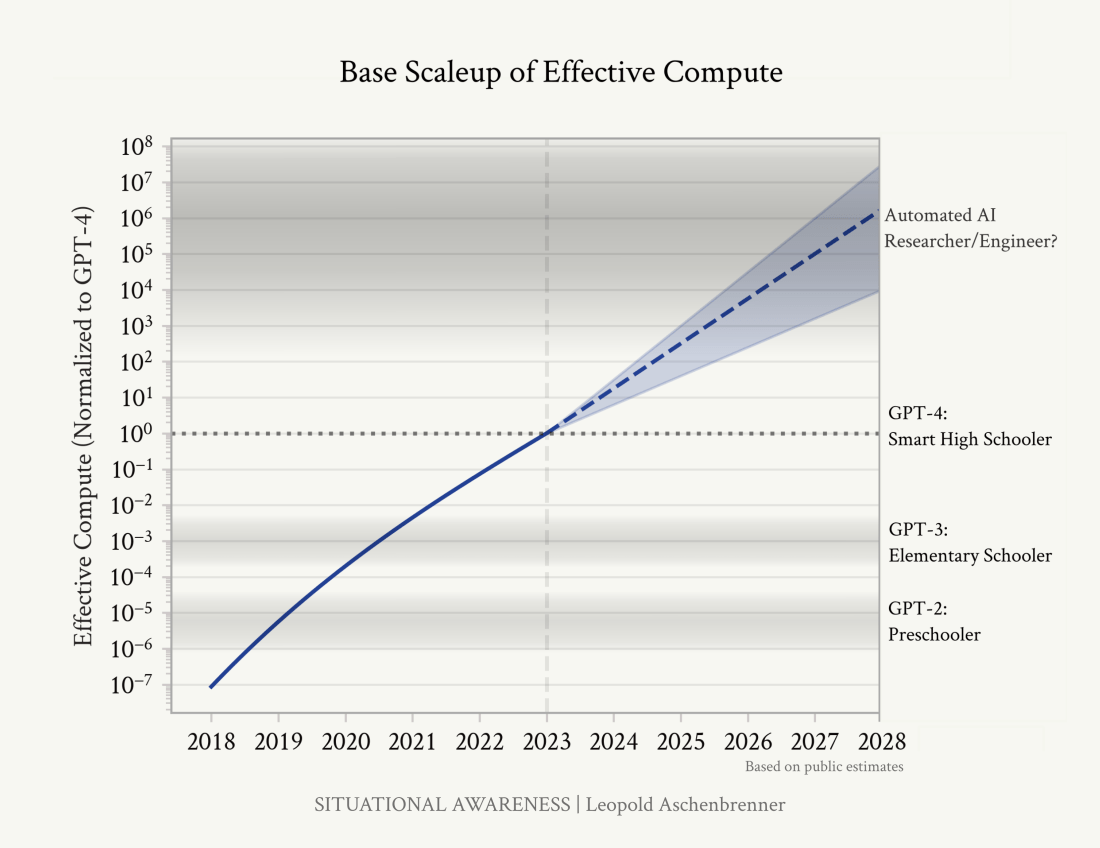

AI stocks look cheap. I expect to buy more sometime over the next few months. But the uncertainties will likely delay the next bull market long enough that it’s wise to wait for more news before buying.